There will be significant changes and options in Michigan’s auto insurance coverage that will go into effect on July 2, 2020. This document will provide insight into the major alterations to the law that have a direct impact on the decisions you need to consider when choosing coverage levels.

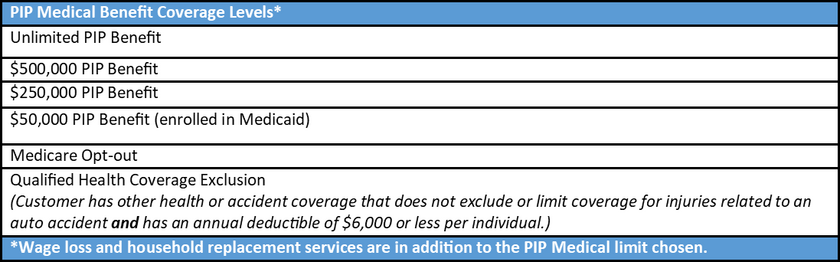

Michigan’s current law requires all auto insurance policies to provide unlimited medical and rehabilitation benefits, also known as personal injury protection (PIP) benefits. Effective July 2, 2020, purchasers of auto insurance in Michigan will have multiple PIP benefit levels from which to choose. These policy benefits are:

If opting out of medical and rehabilitation benefits on your auto policy, many health insurance policies DO NOT provide coverage for attendant care, custodial care, wage loss, other benefits provided by the auto policy medical benefits and may limit rehabilitation benefits. It is also important to remember that your health insurance will still require co-pays, deductibles and co-insurance that your auto policy may not require.

After July 2, 2020, the default liability limit will be $250,000 per person / $500,000 per occurrence. You may elect to lower limits by signing an acknowledgement form, but not lower than $50,000 per person / $100,000 per occurrence.

It is important to know that individuals injured in an automobile-related accident can seek financial compensation not covered by their own policy from the at-fault party. Due to this significant change in the ability for injured parties to sue for medical, rehabilitation, and other costs, higher limits and a personal liability umbrella policy should strongly be considered.

Effective July 2, 2020 the MCCA per vehicle assessment will drop to $100 for those who choose to keep their unlimited PIP benefits. Those who select lower limits will not be charged the assessment.

Please reach out to your BHS Insurance agent to discuss your personal situation and receive more detailed information on determining the coverage options.